You are here:Bean Cup Coffee > markets

Bitcoin Stock Price: A Comprehensive Analysis

Bean Cup Coffee2024-09-21 07:58:44【markets】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as one of the most talked-about cryptocurrencies in the world. airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as one of the most talked-about cryptocurrencies in the world.

In recent years, Bitcoin has emerged as one of the most talked-about cryptocurrencies in the world. Its unique features, such as decentralization, limited supply, and the ability to be used as a digital asset, have attracted the attention of investors and speculators alike. One of the most crucial aspects of Bitcoin's success is its stock price, which has experienced significant volatility over the years. This article aims to provide a comprehensive analysis of Bitcoin's stock price, examining its factors, trends, and future prospects.

Bitcoin Stock Price: Factors Influencing It

Several factors influence Bitcoin's stock price, and understanding them is essential for anyone looking to invest in this cryptocurrency. Here are some of the key factors:

1. Market Supply and Demand: The supply of Bitcoin is limited to 21 million coins, as per its creator, Satoshi Nakamoto. When demand for Bitcoin increases, its price tends to rise, and vice versa. This supply and demand dynamic is a primary driver of Bitcoin's stock price.

2. Regulatory Environment: Governments and regulatory bodies worldwide have varying stances on cryptocurrencies. A favorable regulatory environment can boost Bitcoin's stock price, while strict regulations can lead to a decline.

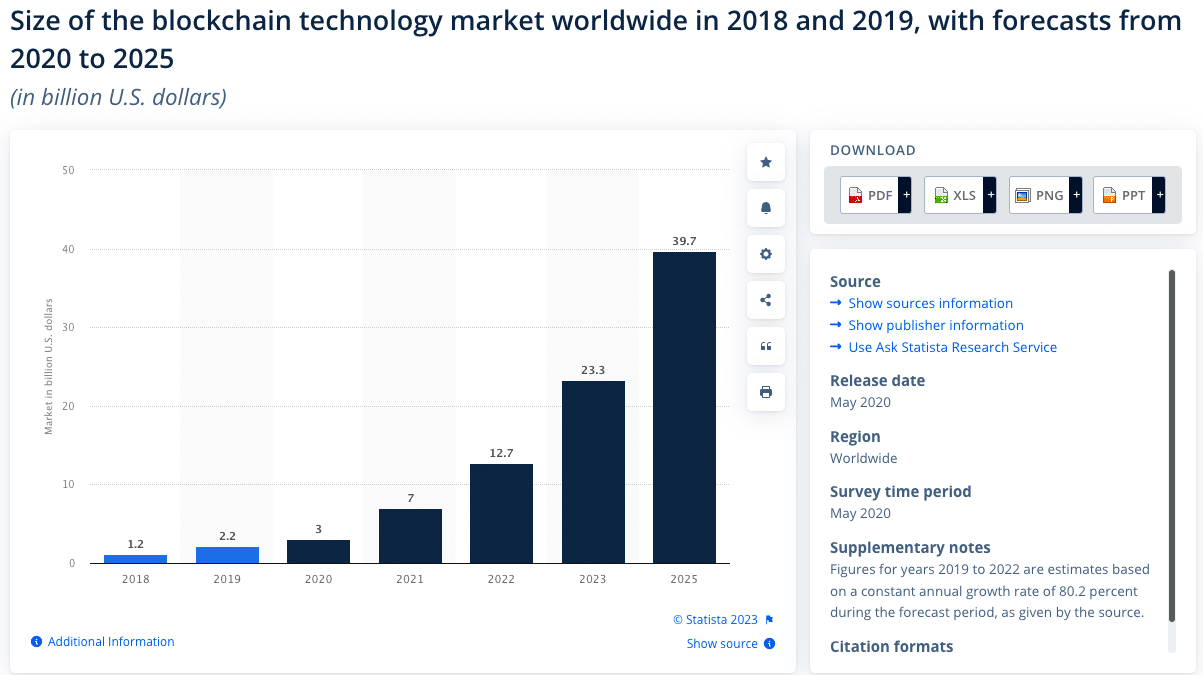

3. Technological Developments: The success of Bitcoin relies heavily on its underlying technology, blockchain. Any significant technological advancements or breakthroughs can positively impact Bitcoin's stock price.

4. Market Sentiment: Investor sentiment plays a crucial role in determining Bitcoin's stock price. Positive news, such as increased adoption or partnerships, can lead to a surge in price, while negative news can cause a decline.

5. Economic Factors: Economic conditions, such as inflation, currency devaluation, and geopolitical tensions, can influence Bitcoin's stock price as investors seek alternative investments.

Bitcoin Stock Price: Trends and Patterns

Bitcoin's stock price has experienced several trends and patterns over the years. Here are some notable ones:

1. Bull and Bear Markets: Bitcoin has seen several bull and bear markets, with periods of rapid growth followed by significant corrections. The most notable bull market was in 2017, when Bitcoin's price surged from around $1,000 to nearly $20,000. The subsequent bear market saw the price drop to around $3,000.

2. Volatility: Bitcoin is known for its high volatility, with prices often experiencing sharp ups and downs. This volatility can be attributed to various factors, including regulatory news, technological developments, and market sentiment.

3. Seasonal Trends: Bitcoin's stock price has shown seasonal trends, with a tendency to rise during the first half of the year and decline during the second half. This pattern may be related to tax considerations and investor psychology.

Bitcoin Stock Price: Future Prospects

The future of Bitcoin's stock price remains uncertain, but several factors suggest that it may continue to be a significant asset class:

1. Increasing Adoption: Bitcoin's adoption as a digital currency and investment vehicle is growing, with more businesses and countries accepting it as a form of payment.

2. Technological Advancements: The ongoing development of blockchain technology and its integration into various industries may further boost Bitcoin's stock price.

3. Alternative Investments: Bitcoin is often seen as a hedge against inflation and economic uncertainty, making it an attractive alternative investment to traditional assets like stocks and bonds.

4. Regulatory Clarity: As governments and regulatory bodies worldwide continue to develop policies regarding cryptocurrencies, a clearer regulatory environment may lead to increased investor confidence and a rise in Bitcoin's stock price.

In conclusion, Bitcoin's stock price is influenced by various factors, including market supply and demand, regulatory environment, technological developments, market sentiment, and economic factors. While its future remains uncertain, the increasing adoption and potential as an alternative investment suggest that Bitcoin's stock price may continue to be a significant asset class in the years to come.

This article address:https://www.nutcupcoffee.com/blog/50f66499285.html

Like!(3175)

Related Posts

- How to Make a Physical Bitcoin Wallet: A Step-by-Step Guide

- Bitcoin Cash Korean Mob: A Growing Community of Crypto Enthusiasts

- How High Can Bitcoin Price Go?

- How to Send Bitcoin from Revolut to Another Wallet

- The Stock Symbol of Bitcoin Cash: A Comprehensive Guide

- Bitcoin Low Price 2019: A Look Back at the Cryptocurrency's Lowest Point

- In the realm of cryptocurrency, 2011 marked a pivotal year for Bitcoin, with significant developments in mining activities. This article delves into the world of 2011 Bitcoin mining, exploring its impact on the nascent digital currency landscape.

- **The Rising Costs of Mining for Bitcoins: What You Need to Know

- When Was Bitcoin Cash Split: A Comprehensive Look at the Event

- Las mejores wallet de bitcoin: How to Safely Store Your Cryptocurrency

Popular

Recent

What is happening to Bitcoin Cash?

Title: Mycellium Wallet: A Comprehensive Guide to Buying Bitcoin

Bitcoin Hardware Wallets: The Ultimate Security Solution for Cryptocurrency Storage

Bitcoin Mining Sites in the Philippines: A Growing Industry

FPGA Based Bitcoin Mining Free Circuit: A Comprehensive Guide

Old Computers for Bitcoin Mining: A Sustainable Approach

How to Withdraw Ethereum from Binance to Trust Wallet

Where Does Bitcoin Mining Occur in the US?

links

- Heritage Sports Bitcoin Cash: The Fusion of Tradition and Innovation in Sports Betting

- In the ever-evolving world of cryptocurrencies, Bitcoin has emerged as one of the most popular digital currencies. With its decentralized nature and the promise of financial freedom, Bitcoin has captured the attention of investors, entrepreneurs, and tech enthusiasts worldwide. One crucial aspect of managing Bitcoin is the use of wallets, which serve as digital safes for storing and securing Bitcoin. This article delves into the world of Bitcoin wallets, specifically focusing on the 2012 Bitcoin wallets.

- How Much to Earn Bitcoin Mining: A Comprehensive Guide

- **The Rise of Pokemon Binance Smart Chain: A New Era in Crypto Gaming

- Butte, Montana, has recently become a hotbed for Bitcoin mining jobs, attracting a growing number of tech-savvy individuals to the region. With the rise of cryptocurrency and the increasing demand for digital currencies, Butte has positioned itself as a leading hub for Bitcoin mining operations. This article delves into the world of Butte, Montana Bitcoin mining jobs, exploring the opportunities and challenges that come with this burgeoning industry.

- In the ever-evolving world of cryptocurrencies, Bitcoin has emerged as one of the most popular digital currencies. With its decentralized nature and the promise of financial freedom, Bitcoin has captured the attention of investors, entrepreneurs, and tech enthusiasts worldwide. One crucial aspect of managing Bitcoin is the use of wallets, which serve as digital safes for storing and securing Bitcoin. This article delves into the world of Bitcoin wallets, specifically focusing on the 2012 Bitcoin wallets.

- Best Place to Cash Out Bitcoins: A Comprehensive Guide

- **Understanding the TRX to USDT Conversion on Binance

- Cotação Bitcoin Cash Mercado Bitcoin: Understanding the Current Trends and Future Prospects

- Bitcoin Selling Price in Ghana: The Current Market Trends and Future Prospects